Investment Advisory

Resilient, diversified portfolios informed by macro regimes and machine-learning risk models.

We combine macroeconomic expertise with quantitative research and machine learning to forecast trends, design resilient portfolios, and inform corporate decisions.

Three ways we help clients move from signal to strategy.

Resilient, diversified portfolios informed by macro regimes and machine-learning risk models.

Nowcasts and scenarios using high-frequency data, DFM/EMP, and policy reaction frameworks.

Data-driven valuations and competitive analysis to unlock operational and capital allocation wins.

At Omega Economics, we bring together economics, computer science, and critical thinking to provide clarity in a complex world. We specialize in identifying macroeconomic and financial risks, helping our clients anticipate challenges, seize opportunities, and design strategies that endure shifting global dynamics.

Our approach combines advanced methodologies with practical insight. From forecasting economic cycles to optimizing portfolios and uncovering patterns in data, we deliver solutions that are precise, adaptive, and tailored to each client’s unique context.

Focused on three core areas—macroeconomic forecasting, asset management, and data science & analytics—we work with you to strengthen resilience, reduce uncertainty, and create a clear path toward long-term success.

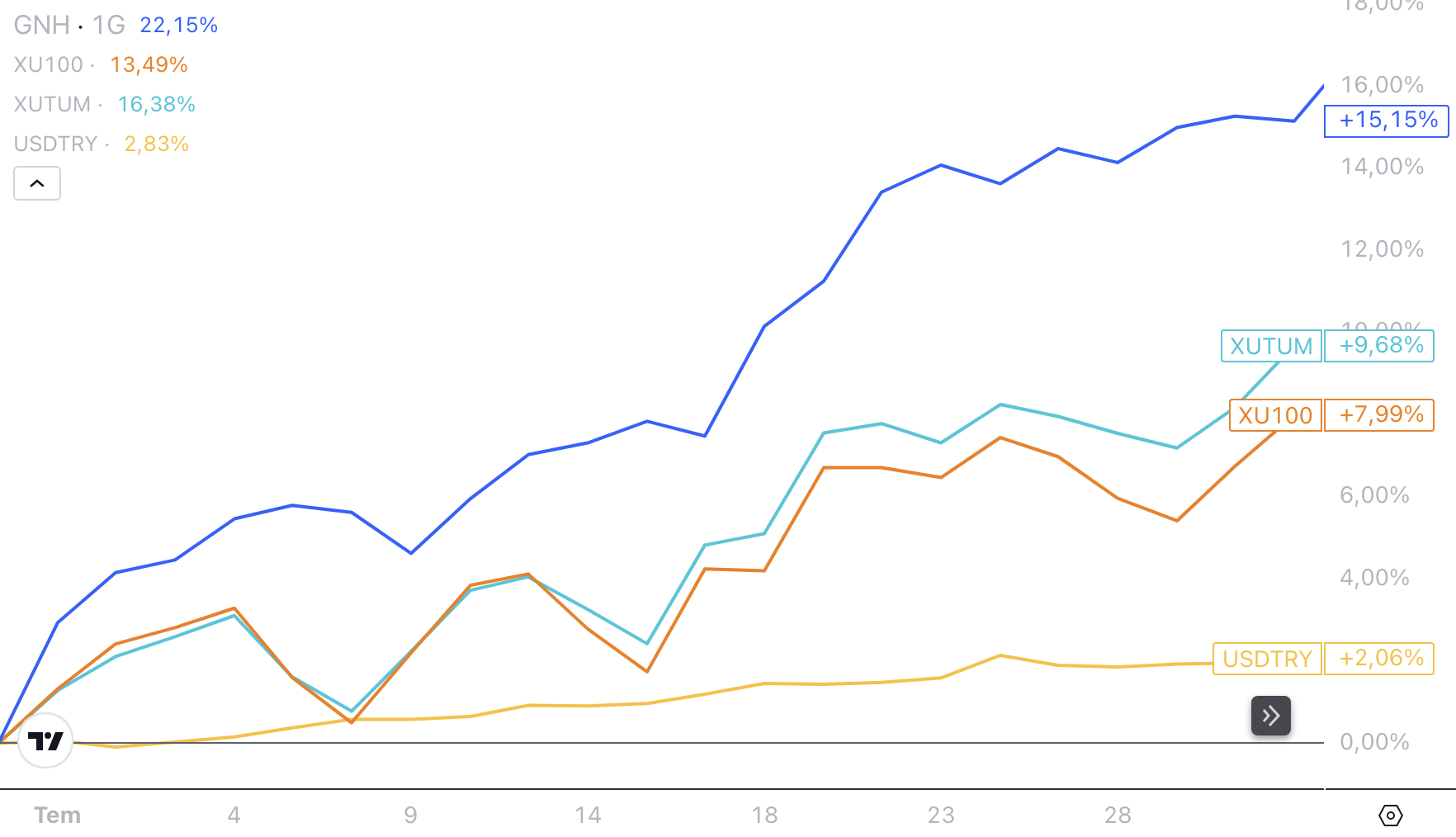

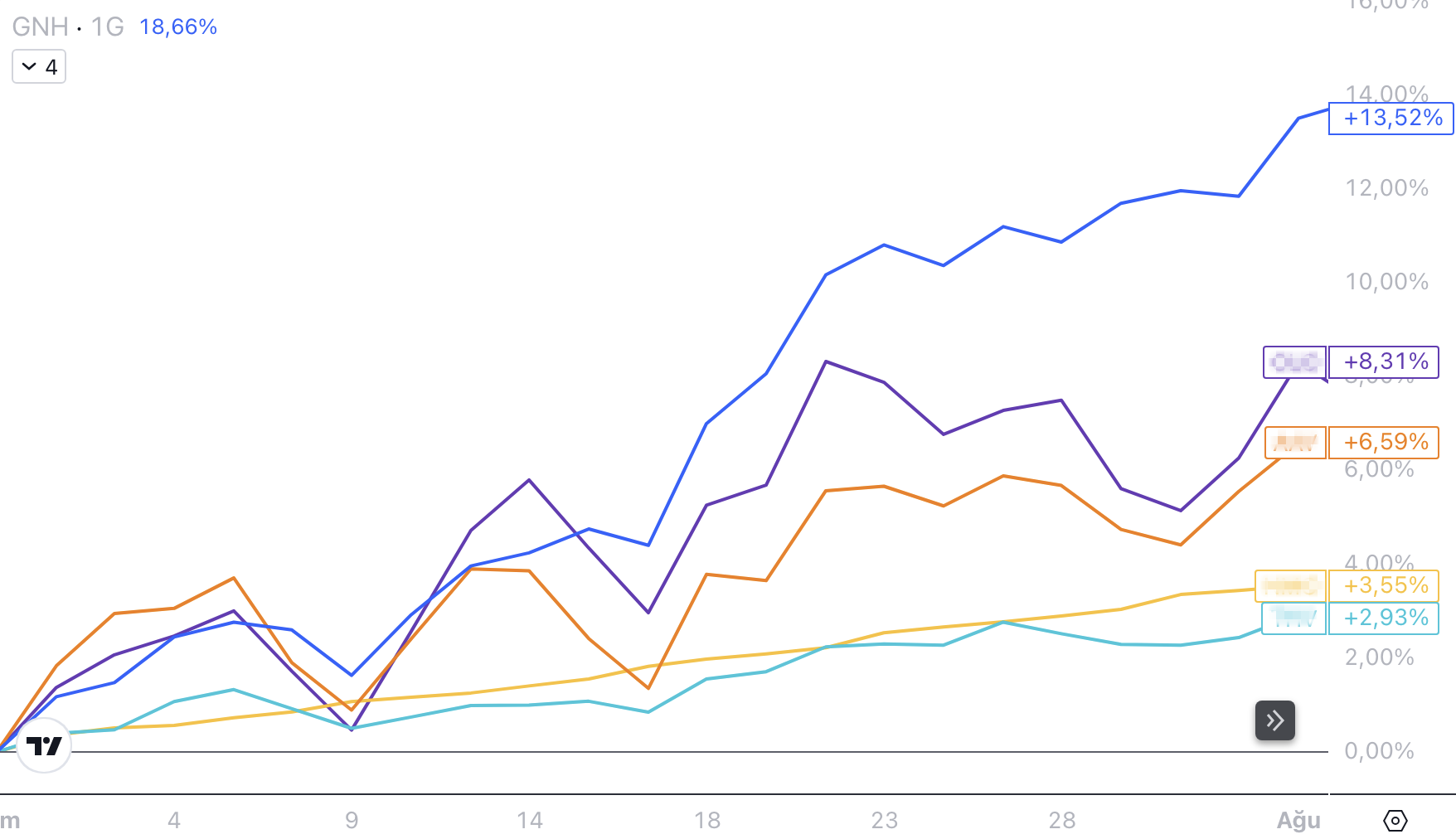

Efficient market allocation across BIST equities with stochastic weighting of conditional correlation matrices. Forward probabilities are informed by macro-financial policy modeling (FPAS, DFM, EMP).

| Fund Code | GNH |

|---|---|

| Fund Title | Global MD Portföy Algoritmik Model Hisse Senedi Fonu (Hisse Senedi Yoğun Fon) |

| Umbrella Fund | Hisse Senedi Şemsiye Fonu |

| Management Fee (Annual) | 2.90% |

| Performance Fee | - |

| Platform Trading Status | Listed on TEFAS |

| Benchmark | 90% BIST 100 Total Return Index, 10% BIST-KYD Repo (Gross) Index |

Under the fund’s investment strategy, at least 80% of total fund value is continuously invested in equities traded on Borsa Istanbul and in participation units of exchange-traded funds established to track indices related to those equities.

In selecting assets and determining their weights, we rely on outputs from Omega’s next-generation multi-equation country-risk profile, capital-market signal-processing forecast algorithms, and a proprietary financial econometrics–based portfolio optimization model. Inputs include historical prices of the securities and their peers; domestic macroeconomic indicators (growth, inflation, interest rates, unemployment, etc.); external macro factors (international capital flows, policy decisions of central banks in trading-partner countries, etc.); micro indicators (market value, P/B, period net profit/loss, total assets, etc.); market data (indices, FX, etc.); technical indicators (momentum, volatility, volume, trend, etc.); financial models (Mean-Variance Portfolio Optimization, etc.); optimization objectives (e.g., Sharpe); optimization constraints (e.g., asset-weight limits); and statistical models (e.g., covariance matrix) to form the optimal portfolio.

Update proposals are threshold- and schedule-driven. Quantitatively identified update thresholds enable dynamic, strategy-based management. Depending on market conditions and the portfolio manager’s views, changes may occur more frequently. In short, the fund uses advanced statistical modeling to determine a strategy for ideal conditions, while the manager blends those results with economic judgment to set the final holdings and position sizes.

Ready to turn data into growth? Send a note and we’ll reach out.

Maslak Mah. Maslak Meydan Sk. Veko Giz Plaza No: 3, İç Kapı No: 85, Sarıyer / Istanbul